Effective. Efficient. Expeditious.

Committed to Helping Our Clients Succeed

Blockchain Global Capital is a digital asset private fund that deploys strategies on our clients behalf including systematic algorithms and trading, secure cold storage as well as signals from on-chain analysis, technical analysis, sentiment analysis and more.

Committed to Helping Our Clients Succeed

Fund Managers should be paid for performance.

We make money when our clients make money.

Systematic Algorithms

Parameters to help define trending markets, attempt to capture upside and limit downside risk.

Secure Custody

Cold storage practices which include capability for physical hardware wallets, multi-factor authentication and consensus protocols to help keeps assets safe.

Tax Reporting

By utilizing our fund, clients benefit by being provided a K-1 document for their tax reporting

needs.

Committed to Helping Our Clients Succeed

Our fund specializes in Bitcoin and Ethereum trading models, offering investors several benefits to participate in the digital movement.

By utilizing automation, our fund eliminates human biases and emotions, resulting in faster and more accurate trading decisions.

Our risk parameters, market trend analysis, and diversification strategies help to reduce risk exposure, and help to balance a portfolio.

Trading Efficiency

Risk Management

Systematic Trading

Committed to Helping Our Clients Succeed

At our digital asset hedge fund we prioritize security of client funds. With a strong culture of integrity and honesty, we ensure transparent communication and ethical standards throughout our operations.

A dedicated approach to different investment strategies assists as introduction to the digital asset space. We maintain a client-centric focus, providing regular updates, performance reporting, and proactive support. We strive to keep up to date in the fast moving industry, including regulatory compliance and keep clients informed of recent and applicable events.

Committed to Helping Our Clients Succeed

We work hard to provide an avenue for clients to enter the dynamic digital asset market in a simplified way.

Average Investment

$250,000

Our LP minimum investment is $100k

In order to become a Limited Partner (LP) in our fund you must meet the minimum investment requirements, and meet accredited investor requirements.

Overview

Summary

Our fund's custody of assets includes

select insurance on digital assets

through affiliated exchanges, compliant

reporting and regular audits as well as key management

Committed to Helping Our Clients Succeed

In addition to the aforementioned services, we want our clients to understand and benefit from these new advanced technologies.

Remote Q&A Sessions

We offer up to 10 monthly Zoom calls to all of our clients (LP's) to answer any and all questions about the fund, market analysis, and customer support.

Network

We have a diverse team of unique individuals who have created businesses in financial services, music and production, data, automation and medicine. This wealth of perspective helps in navigating today's complex and ever-evolving markets.

Read Our Latest Blogs

Keep up to date with the latest news and learn about the tools we use to protect your investment.

Bitcoin ETFs

"Bitcoin's ETF approval is not just a regulatory win; it's a cultural shift. It's the moment Wall Street embraces what it can't afford to ignore."- Blockchain Global Capital

INTRODUCTION:

In recent years, the financial landscape has been teeming with anticipation and speculation about the integration of cryptocurrency into mainstream investment portfolios. Amidst this transformative era, the approval of Bitcoin Exchange-Traded Funds (ETFs) stands out as a monumental milestone, drawing parallels to the excitement and significance of a traditional Initial Public Offering (IPO). This groundbreaking development heralds a new chapter in financial history, democratizing access to Bitcoin for a wider array of investors and underscoring its legitimacy as an investable asset. In this blog, we explore why Bitcoin's ETF approvals are considered Bitcoin's IPO moment, marking a pivotal juncture in the journey of digital currencies from the fringes of finance to its very core.The financial world has witnessed a pivotal transformation with the introduction and subsequent approval of Bitcoin Exchange-Traded Funds (ETFs). This development marks a significant milestone, reminiscent of an Initial Public Offering (IPO) for Bitcoin, ushering in a new era of mainstream acceptance and institutional investment in the cryptocurrency space. This article delves into why Bitcoin's ETF approvals are heralded as Bitcoin's IPO moment and the implications for investors and the broader financial ecosystem.

Bridging Traditional Finance and Cryptocurrency

Bitcoin ETFs serve as a critical bridge between the traditional financial markets and the burgeoning world of cryptocurrency. They offer investors a familiar, regulated, and easily accessible means of investing in Bitcoin without the complexities and security concerns associated with direct cryptocurrency ownership and storage. This accessibility is akin to the way IPOs open up opportunities for the public to invest in private companies, broadening the investor base and enhancing liquidity.

Institutional Adoption and Legitimacy

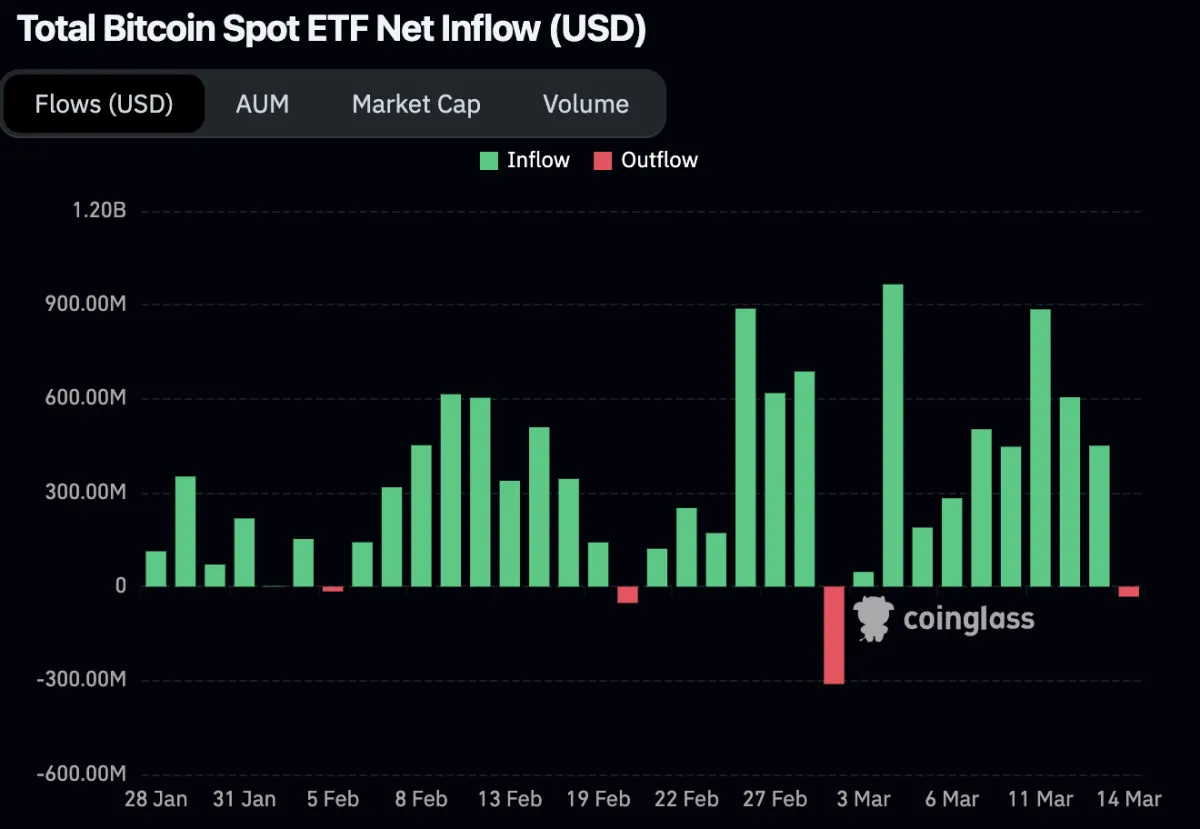

The approval of Bitcoin ETFs by regulatory bodies is a strong signal of the growing legitimacy and acceptance of Bitcoin as a viable asset class. Similar to how a successful IPO can validate a company's market position and business model, Bitcoin ETF approvals validate the cryptocurrency's value proposition to both institutional and retail investors. This increased legitimacy paves the way for substantial capital inflows from institutional investors, endowments, and pension funds, mirroring the influx of investment that typically follows a company's IPO.

Market Impact and Visibility

Just as an IPO can significantly raise a company's profile and market visibility, the launch of Bitcoin ETFs has propelled Bitcoin and cryptocurrency into the spotlight. It has ignited mainstream media coverage and public discourse, further solidifying its position in the financial landscape. This heightened visibility attracts a wider range of investors, contributing to increased adoption and potentially more stable markets over time.

Liquidity and Price Discovery

Bitcoin ETFs enhance liquidity and facilitate better price discovery in the cryptocurrency market. By aggregating buying and selling activity within traditional financial venues, these ETFs provide a more accurate reflection of Bitcoin's market value, much like how trading in a company's shares post-IPO leads to more efficient price discovery based on broader investor participation.

Regulatory Framework and Investor Protection

The regulatory scrutiny accompanying Bitcoin ETF approvals introduces a level of investor protection previously lacking in the cryptocurrency space. This regulatory framework, akin to the oversight present in traditional securities markets post-IPO, offers investors a safer environment, potentially reducing the risk of fraud and market manipulation.

Other resources to help you get started with Trading:

Before You Trade Checklist:

Here is a quick checklist to get you started with you website blow. Remember imperfect action beats inaction, get started and keep publishing.

1. Market Analysis

Review Economic Calendars: Check for major upcoming economic events that could affect market volatility.

Analyze Market Trends: Determine if the market is in an uptrend, downtrend, or sideways trend.

Technical Analysis: Examine charts for patterns, support/resistance levels, and technical indicators.

Fundamental Analysis: Evaluate relevant financial, economic, and political factors that could impact asset prices.

2. Trade Strategy and Setup

Define the Trade Strategy: Ensure the trade aligns with your trading strategy (day trading, swing trading, scalping, etc.).

Set Entry Points: Identify precise entry points based on technical analysis and market conditions.

Set Exit Points: Determine your exit strategy, including both profit targets and stop-loss orders, to manage risk.

Risk/Reward Ratio: Calculate the risk/reward ratio to ensure it meets your minimum criteria.

3. Risk Management

Assess Trade Size: Decide on the trade size, ensuring it is in line with your risk management strategy.

Check Leverage Levels: Confirm the leverage level is appropriate for the trade and your risk tolerance.

Diversification: Ensure the trade does not overexpose your portfolio to a single asset or market.

Stop-Loss Orders: Set stop-loss orders to limit potential losses.

4. Market Sentiment and News

Monitor Market Sentiment: Gauge the overall market sentiment and its potential impact on your trade.

Review Latest News: Check for any recent news that might affect the asset you're trading.

Social Media and Forums: Scan social media and trading forums for additional insights or sentiment indicators.

5. Pre-Trade Checklist

Double-Check Trade Details: Verify the asset, trade size, entry point, exit point, and stop-loss levels.

Platform Functionality: Ensure your trading platform is functioning correctly, with no technical issues.

Internet Connection: Confirm that your internet connection is stable and reliable.

Mental Readiness: Assess your mental state to ensure you're focused and not influenced by emotions.

6. Compliance and Documentation

Compliance Checks: Ensure the trade complies with any relevant regulatory or exchange requirements.

Record Keeping: Prepare to document the trade details for your records and performance analysis.

Other resources to help you get started with blogging

Start your own blog checklist:

Here is a quick checklist to get you started with you website blow. Remember imperfect action beats inaction, get started and keep publishing.

Create your blog page then add the blog element

Add the blog element to your page and select if you want compact or list view

Start planning your blog topics by Identifying what resonates with your audience. If you are stuck you can use sites like - https://answerthepublic.com/

Create an outline serves your company goals.

Write conversationally, like if you were telling a story to a friend

Pick a catchy title.

Use several media types (gif, short video, or image) to deliver your messages.

Use data to back up claims or ideas - make sure to cite all sources❗

Have a call to action and or give your audience something to walk away with.

Take 30 minutes to edit your post.

© 2023 Blockchain Global Capital.

All rights reserved. The content of this website, including but not limited to text, graphics, images, and other material, is protected under both United States and foreign copyright laws. Unauthorized use of this material is strictly prohibited.

Blockchain Global Capital is the legal owner of all intellectual property rights in the material and content displayed on this website. These works are protected by copyright laws around the world and all rights are reserved. You may not copy, reproduce, republish, download, post, broadcast, transmit, make available to the public, or otherwise use any content on our site in any way except for your own personal, non-commercial use.

This website and its content are not to be construed as a form of promotion. This website is intended for informational purposes only and is not intended to be a solicitation or offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction. This website is intended for informational purposes only and is not intended to be a solicitation or offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction.

+1 917-809-7454

Info@BlockchainGlobalCapital.com